Postal Retirement Q&A January 2015 by Roseanne Jefferson

Good Day Postal Employees……and a Very Happy New Year!!!

This has been a very busy month with emails and retirements seminars. It still amazes me how many employees are still confused regarding their benefits in retirement, and the very calculation of their retirement. Many still confuse CSRS rules with FERS (very different) rules in retirement (monthly annuity/pension) calculations. And as I have said for years, there are no cookie cutter retirements. It’s no different…. with 2 exactly the same salaried employees. When filing THEIR RESPECTIVE TAXES, In NO way would it be that those two employee’s tax return would net exactly the same results. Of course it wouldn’t. There would no doubt be a difference in household family tax deductions, almost NO ONE EVER has the same amount of TSP, not every one is entitled to the Special Supplement. Some non-career time is credible if you don’t pay it back (CSRS vs FERS diffences), some is credible with paying it back….and some non-career years you cannot buy back at all. In retirement and as in tax returns….all 3 factors (FERS, Social Security & TSP) play important financial roles in each individuals retirement, which is why it would not be the same…and added..almost never is. So again, your personal financial information plays a huge role in how much income you will have to retire on. The notion that the CSRS is SO MUCH BETTER, is only because employees will not put the maximum (matching) percentage in TSP to receive the matching funds from the employer. And the biggest percentage of a FERS employee’s retirement should be their TSP…..and its not…and I do enough to know….you all out there are not doing right by yourselves if you don’t FULLY FUND your TSP.

If I say that the complaints are so LOUD and PROFOUND…just saying that… lets you know…..its NOT where you WORK particularly….its for WHOM you work!! Because that IS the only common thread.

Q 1. Hello Roseanne, I started last year as a full time federal civilian employee. I previously worked for the US Postal Service as a Rural Carrier Associate, for 11 years, from September 1987 through September 1998. During that time I worked nearly one year of full time credit. I am told that since I started with the Postal Service after 1986 that this time is not creditable for FERS and there is no way to even buy back this time toward FERS retirement. Is this correct? If so, where can I go to see this in the regulations? Is that true.

A 2. Please read below the information relative to FERS retirement. This information was taken directly off the opm.gov website.

FERS Civilian Service

- Creditable service under FERS usually includesFederal covered service, that is, service in which the individual’s pay is subject to FERS retirement deductions, such as service under a career or career conditional appointment,

- Unused Sick Leave under FERS can be used to increase an individual’s total creditable service for annuity computation purposes only;

- Federal service performed before 1989, where an employee’s pay is not subject to retirement deductions, such as, service under a temporary appointment, as long as a deposit is paid. There are a few exceptions to the rule that the service must have been performed before 1989. Those exceptions are:

> Part-time, Intermittent, Temporary “PIT” service performed abroad after December 31, 1988, and before May 24, 1998, under a temporary part-time or intermittent appointment pursuant to sections 309 and 311 of the Foreign Service Act of 1980.

> Service performed under the Foreign Service Pension System

> Service as a Senate Employee Child Care Center worker

> Service as a volunteer or volunteer leader in the Peace Corps

> Service as a VISTA volunteer

> Service before 12/31/1990 with either the Democratic or Republican Senatorial

> Campaign or National Congressional Committees

> Service before 12/21/2000 with the Library of Congress Child Development Center

Service as a Senior Official

> Congressional Employees that do no elect program coverage and are subject to the Social Security Amendments of 1983

> Service performed under a Federal Reserve Bank Plan

> Non-appropriated fund instrumentality (NAF) service under P.L. 107-107 that can be used for title to an annuity under the FERS, but not in the computation

CSRS refund service that flips to FERS

Deposit: A deposit is the payment for a period of employment when retirement deductions were not withheld from your salary. The deposit amount is, generally, 1.3% of salary plus interest. You are not required to make this type of payment. However, not making the payment will eliminate this service from being used for title or computation purposes.

Retirement Deductions Never Withheld

Generally, nondeduction service cannot be credited for title or computation unless it was performed before 1989 and a deposit is made.

Deposit for Service Ending before January 1, 1989 and Covered by FERS

You can make a deposit for creditable Federal Employees Retirement System (FERS) service you performed before 1989 during which retirement deductions were not withheld from your pay. The deposit amount is, generally, 1.3% of salary plus interest. Interest is charged from the midpoint of periods of service and is compounded annually. Interest is charged to the date the deposit is paid in full or annuity begins, whichever is earlier. Interest is applied at the rates described in the table. If you do not pay for a period of this type of service, you will not receive credit in determining your eligibility to retire or in computing your retirement benefit.

Deposit for Service Ending after January 1, 1989 and Covered by FERS

With certain minor exceptions, a Federal Employees Retirement System (FERS) employee cannot make a deposit for non-contributory service performed after January 1, 1989

Q 2. Good evening, I saw your name and email information on the postalmag.com web sight. I was hoping you may be able to point me in the right direction. My father-in-law is a retired postal worker. He is gravely ill and is unable to answer questions we have concerning his retirement pay. Can you tell me who my mother-in-law could contact concerning her survivor benefits? Everyone is upset and confused so I am at least attempting to find her the right point of contact. Thank you in advance fr your assistance.

A 2. Hi, I would suggest (if he retired fairly recently) to see if the spouse knows where the paper work that was sent to him by OPM.. Office of Personnel Management. There is a blue booklet (pamphlet) type in blue and white that has information about what the benefits to the spouse. The phone number for OPM is 1-888-767-6738 and you can go to opm.gov. It will be very helpful to find his “CSA number”. All annuitants (postal/federal retirees) have a CSA number. IF this cannot be found, then the social security number is the next piece of information that will be necessary. Roseanne

2. Follow Up: Thank you very much for your prompt response. I don’t think we are able to find any of that information. He retired in 1999. We will call the number. You have been very helpful.

Q 3. I was reading the topic early retirement on the OPM.COM website and it says MRA+10 Retirement

If you have 10 or more years of service, you can retire at the Minimum Retirement Age (MRA).

Age Reduction

Under this type of retirement, your annuity will be reduced for each month that you are under age 62. The reduction is 5% per year (5/12 of a (1) percent per month). However, your annuity will not be reduced if you completed at least 30 years of service, or if you completed at least 20 years of service and your annuity begins when you reach age 60.

You can reduce or eliminate this age reduction if you choose to have your annuity begin at a date later than your Minimum Retirement Age. You can choose any beginning date between your MRA and 2 days before your 62nd birthday.

Does this mean if I have 30 years plus that I can retire before MRA? When I turn 51 next year I will have 27 years in the PO and 3 years in the Army that I bought back last year. My retirement comp year is 1985.

Q 3. Hi, I guess better stated is, if you are at least your MRA and have at least 30 years, that is considered FULL retirement (with no reduction); If you are at least 60 with at least 20 years that also is considered FULL retirement (with no reduction).

When (if) you bought back your military years, yes, that does ADD to the total number of years that are calculated for retirement. But nothing changes the rules about the age and years…..other than an early out retirement. So to answer your question….UNLESS you are at your MRA (and your are NOT retiring under an EARLY OUT authority) and have 30 years, your annuity will be reduced. If you have 30 years and are age 51, you still are not eligible to retire. You still are NOT at your MRA, years are NOT just the factor here. And yes, even with the 3 years you bought back…still, it’s the age that you still have not met yet. Just as an FYI…..MRA+10 is not a great option….just my advise. Roseanne

Follow Up: Not what I wanted to hear, but better to know now

Q 4. Hi Roseanne, I worked as a PTF for about a year and an half in 1987 and 1988. During that time I put some of my money into the Thrift plan the USPS offered. I got divorced and moved in 1988 and never did anything with my Thrift plan. Where would I go, or who would I talk with, to find my Thrift plan money now? Thanks

A 4. Hi, You would call the TSP line at 1-877-968-3778. Or you could go to the website at tsp.gov On that website you will look to find how to withdraw your money….and you could do that on the form TSP-70, which is available on line as well. Once you fill it out….(it doesn’t ask HOW much you have in the fund, only the percentage you want out…and probably that would be 100%. You will be taxed on that amount about 22%. I hope this helps. Roseanne

Q 5. I have a medical condition where I can only work eight hrs per day. I was given a letter stating they were moving my starting time later than others. Doesn’t this justify an eeo complaint. I’m over 50 with over 30 yrs service. If I choose to walk away when would I collect retirement and how much? Would I lose my health ins.? It is amazing when you do your work and am a good employee the unjust tactics and unprofessionalism and disrespect mgmt dishes to me. Just give a letter – no verbal communication at all. Other employees resent me because I leave after 8 hours and they are forced to work overtime.

A 5. I will explain this answer so it really makes sense to you all out there. NO this NOT an EEO complaint. Generally this type of issue is NEVER an EEO. You don’t say, so either you filed a grievance and lost or found out it was not a grievance. As Management, we have the right to modify and change where needed (including employee schedules) for “ efficient use of our employees” It’s not an efficient use of 8 hours of an employee’s time if a portion of the time the employee is there, no work is!!! Eight hours a day is eight hours a day if you start at 6am or 9am. If your begin tour is 0700, and the mail is not at the station until 08:50, in the real “make sense world”, you got to admit changing hours to match when the work is there is more than valid. When a postmaster, manager, or supervisor change’s an employee’s schedule, it has more to do with an instruction from THEIR higher level manager, (you have NO idea of how difficult these jobs are..the juggle of hours…..what operation # to put it these hours in that are not budgeted….like I say you have no, idea!!)……a “direct order” mind you, not from them trying to screw with you personally. And I am sure that if offered an early out you would take it….and you should, because you need a few years to reach your MRA. AND I AM NOT SO FAR FROM THE BUBBLE TO NOT KNOW……yep there are managers, postmasters and supervisors that will REACH OUT to screw with you. Years ago I made this statement in this column, “EVERY POSTAL EMPLOYEE HAS HAD THEIR DAY (OR DAYS) IN THE SUN WITH THE PO “…..every one of us!! We all have had issues with upper mgmt, lower mgmt, union at one time or another in their career. And generally the reason is those damn 3percenters!!

3Percenters:. THE SCREW UP’s/LOSER’s, (craft & management alike…union too) the 3% that nothing is EVER right for – nothing ever. You know, a 3% employee, is the first one to call “tech” on another say carrier, but expect solidarity from fellow carriers in their behalf. Walks juuuust..on the edge…. never giving an ounce more, but expects concessions everywhere. You all know who you are, and so do your fellow employees, KNOW WHO YOU ARE.

If your begin time is 7:00 am, and mail is not getting to the station to be worked until 8:30 (yah, yah, I know its because of the PLANT not getting the mail to the stations on time…. .ssdd) changing your schedule DOES make sense. By verbally communicating this is not correct procedure, a letter is correct procedure. If you were told this verbally and it was something you didn’t want to do, you would DEMAND it in writing. And the letters usually contain language that states – “ For the good of the service”. And it is for the good of “efficient” service. Wake UP!! 8 hours is 8 hours….you could be in a real “crappy” district and those “limited” 8 hours ya got there….could be spent on Tour 1 in the a plant…”quityerbitcihn” for real!

Till We speak again Roseanne

Postal Retirement Q&A February 2015 by Roseanne Jefferson

Good Day Postal Employees…. I was almost done with the column for this month, and then received an email, I will share…..and SANITIZED to ensure that the reader’s identity is protected…… some history….(over 20 emails in the course of a year, from a former federal (non-postal) & former USPS employee, who has since left federal employment quite a long time ago).

A non “Reader” of this column was referred to me by someone who reads this column. According to the emails, with many questions they had regarding their POSSIBLE federal retirement, and having called OPM, USPS and other former federal agency that employment was in, was unsuccessful in obtaining any information. After many emails, and having only information of what their contributions were to the retirement fund for each period of federal employment. With nearly 8 years of total federal service, 2 of those 8 years federal years….the retirement funds were withdrawn). The balance of the federal years retirement contributions remained in the fund at OPM.

The basic question all along had been “Am I eligible to receive an annuity, (as no one in any federal agency that was called could answer that question for this reader); the questions were: WHEN could they receive the annuity; and finally wanted to know how much the annuity would be. After working to find out this information and responded to this reader…keeping in mind in the entire year, after giving VERY detailed responses, including how the retirement is calculated using “Your Hi-3 average salary, times 1%, then times the number of years worked…etc….after all that….this was the response of that reader…”Hi Roseanne, and thanks, I thought you were going to help me calculate what my annual income would be, assuming I waited until I was 62. In an earlier email, you sent me a formula to calculate it, but I said I didn’t understand it. Can you do that?

Roseanne’s response: WOW…& here I thought you had SOME semblance of understanding about this FERS retirement plan. After all you did work for the Feds in total of almost 8 years. I am sure you have all your pay stubs for when you worked at the PO…as your emails appear – so detailed oriented, & lucky for you that’s the only way to find out how much you receive in retirement is by having all your pay stubs.

Unfortunately sending me all that info was actually relative to being EVEN ELIGIBLE to collect a retirement check, not the dollar figure, just if you were eligible. Apparently you didn’t understand that it’s not your contributions of what you put in the fund, that has a bearing on your monthly annuity BUT YOUR HIGH 3 AVERAGE SALARY. So I couldn’t give you that answer, because I don’t know what your h3 salary was. But when you find your stubs add what your last 3 yrs of base (total of last 3 divided by 3… for the AVERAGE) salary. Take that yearly number and then X by 1%. Take that figure and X by (5) years worked- then divide by 12. Your monthly annuity. Roseanne

FINAL Reader Response: Hello WOW

I won’t use a lot of CAPS like you, which equates to someone YELLING at the reader. In case you are providing so-called ‘advice’ on a regular basis to others, and are interested in improving this and your other communication dysfunctions, I recommend intensive training in effective communication or, at a minimum, visiting a psychologist. I actually think you do more damage than good.

My first emails over a year ago were very specific about what I was seeking, and then you led me down a very winding and backtracking path (constantly insulting me along the way), and then arriving at nothing of value. I thought about documenting my points, but do not want to waste any more of my time.

However, I will extract some value from this experience, by removing your name from emails, and then sending these along with my story to the Director of OPM, and to her boss at the White House Office of Management and Budget, about the difficulty in getting help on the issue.

I tried to be courteous along the way, but it’s very apparent you have not intention of reciprocating.

Please do not respond, as I will delete your email on arrival.

SO…there ya go!! I’ve reviewed every single email that was written, I was not rude, discourteous or insulting….in any email. One would think that IF I insulted you in even 1 email,…why would you keep writing me? After one year, I couldn’t help but say WOW…feeling like I have spoon fed someone information for an entire year….phone numbers, addresses, links, form numbers….how to get the forms….how to calculate your retirement with the high-3 average salary. After all that information over a year’s period of time, with I thought a complete explanation of the FERS retirement system, that was the resulting email.

Let me be clear here, and this can be verified…I don’t get paid for writing this column, or spending time answering the multitude of questions I answer every month…it’s a gift of LOVE back to my postal employees because I know you all don’t have very many resources to go to for answers to what I consider…common questions.

That was my thank you gift…that email. Perhaps I should take a break from writing the column for a few months….maybe spend a few months in an intensive effective communication class (so I can IMPROVE my skills) and of course visiting a psychologist…hey I was a postal worker…who doesn’t need therapy after working for them ?

Q 1.Hi Roseanne, I’m thinking of retiring soon with 18.5 years (FT) at age 61. My question is will I receive a check for unused sick leave. As of now I have around 116 hours. When does that check come? After retirement? Thanks for you help. T

A. 1 Hi T, Any unused sick leave (all which is “earned”) is “credited” (or added) to your overall years (& months) of credible career federal service, to calculate your retirement (monthly annuity check). If you retire with less hours in sick leave to equal one month, none of those “50” hours would be lost. When you order your “annuity estimate”, it shows exactly how your sick leave is calculated towards our retirement. Roseanne

Q 2. Hi Roseanne, Thanks for all of your great info. It’s good to know someone can understand all of this!

My question concerns military buy-back. Prior to starting at the post office in 1981, I served 3 years in the military. At the time I was hired, I had planned to be there only a few years until my husband completed college, then I would quit and go to school. Long story short, I’ve never paid for those three years in the military. If I am correct, since I don’t have enough quarters for Social Security, I don’t have to pay for my military time. I’m 55 with nearly 37 years of creditable service and planning to retire soon. I don’t PLAN on working again after retiring, so I’m wondering if I did pay the deposit, which would be pretty hefty by now, will it increase my annuity or not, since I’m already getting credit for those military years. Just wondering if it’s worth it or not. Everyone thinks I’m crazy for not buying it back. Thanks in advance for your reply! Sincerely G

A. 2. OMG!!!! YOU GUYS ARE LISTENING TO ME……thank you….thank you…Hi G, tell them you are not crazy…..you are 100% correct. NOW!!! remember…you said you were not going to go back to work..so don’t…and trust me, you won’t need to….and if you are a CSRS, and as many retirement’s that I have done you are going to have a slamming retirement with 37 years. Congratulations….job well done! Roseanne

Q 3. Roseanne, I was just checking my online OPF and I found a report that was dated 01/11/2015 and was titled RTR Employee Detail Report. I wondered what it is for? I was also looking and it lists every year and my designation. It had a column titled lost hours. I have 0 every year except the second year I worked back in 1985. Why am I showing 4 “lost hours” for 1985? I don’t understand how I would have 4 lost hours? I’m planning on retiring this year and I thought I would check my OPF and just see if there was anything I needed to look into. Thanks in advance for your time. – Best Regards

A. 3. Hi, Back in 1985, and with just 4 lost hours, I would not spend any time stressing on that. ON a wholesale “view” of your total federal credible service time….it really means nothing….don’t worry. Retire, and don’t stress about those 4 hours. Roseanne

Q 4. Hi. I have a question. I have just over 30 years in the post office. I just turned 53 on January 3rd. I have called OPM to answer my question, but would love your take on it as well as some verification. I have read that since I have 30+ yrs of federal service, the entire time with P.O. and under FERS, that I can separate from the P.O.(fed service) now, at 53 and defer my retirement annuity begin date until I reach 56(my MRA). I further was told by OPM that at that time, 56-MRA, I get my retirement annuity AND the FERS supplement( which will not be reduced ) because I had over 30 yrs of fed service, and met my MRA of 56 prior to receiving my deferred retirement annuity. I realize I do not get credit for my sick leave, (over 1550 at this time). ouch!. But the stress of the job has taken a toll on my health, namely extremely high blood pressure, even with 2 types of meds to control it. I need to resign my position soon and don’t want to lose what I have worked towards for 30+ yrs. so if you could confirm/affirm what I have read, I would greatly appreciate it. As an aside, I plan to resign stating the reason is for health reasons, in hopes that a very slim possibility of some unemployment compensation while I transition to a new life without the Post Office. Thank you in advance. Desperate

MY 1st Response- Much of your email is littered with bad information, confusing information & some correct information. But mostly your are on a path that you are NOT going to like. I will later today email you back with the WHYS of what I am saying. Have an early appt today, so will respond more later. Roseanne

A 4. Hi D, Please see the information below.

This is what regulations say about Deferred Retirement: “If you separate from service before you are eligible for an immediate annuity and you do not take a refund of your retirement contributions, you will be eligible for a deferred retirement benefits as soon as you attain the age that corresponds with the age and service combinations shown below. You will not be permitted to continue Federal Employees Health Benefits or Federal Employees Group Life Insurance. You are not eligible for the special retirement supplement”.

Age Service

MRA 30

60 20

62 5

MRA 10 (reduced)”

I hope this has helped. Roseanne

Response Thanks, Roseanne, I guess I must have misunderstood the following paragraph. It must mean, it there is an early out or involuntarily separated.

13. FERS employees are eligible for a Special Retirement Supplement if they retire:

– At the Minimum Retirement Age (MRA) with 30 years of service.

– At age 60 with 20 years of service or;

Upon involuntary or early voluntary retirement (age 50 with 20 years of service, or at any age with 25 years of service). Under the

Voluntary Early Retirement (VER) or involuntary retirement, this supplement is payable only if you have reached your MRA. If you

are separating at less than MRA, the supplement will not be paid until you reach MRA.

Final Response: Hi D, And this is why I do what I do… Roseanne

Q 5. Hi Roseanne hope you can answer this question very quickly. I have my conference call for my retirement on January 13. My retirement date is Jan 31. I am a CSRS employee & with my sick leave will have 33 years 3 months and 27 days . My question if I change my date to Feb 3 will that change the 27 days to 30 days and make it a full month to make it 34 years 4 months . Thank you for a hopefully quick answer. SF

A 5. Hi SF, What date does the annuity estimate say? (ALL Annuity Estimates are dated for the first of ANY month) And as a CSRS employee you CAN retire up to the 3rd of any month. If what you say is true – those 27 days SHOULD give you the entire month…..I said SHOULD…let me know what HRSSC says when you ask. AND DO ASK—- FYI -it’s NOT going to be just YOU on this retirement phone conference. There are SEVERAL other postal employees on the same conference phone call as you, Just letting you know. Roseanne

Q 6. How does one go about applying for postal disability retirement? How long does it take to get through the process of disability retirement? If one has to leave employment before the disability retirement goes through do they get back pay? What requirements does one need in order to qualify for disability retirement? Would one be better off going for postal disability retirement or Social Security Disability retirement? I know I have asked a lot of questions so if you need more information please let me know. Thank you.

A 6. To begin the process of disability retirement, you should call HRSSC at 1-877-477-3273; request a disability annuity estimate. They will be able to assist you beginning this process. Roseanne

Till whenever we speak again…………Roseanne

Postal Retirement Q&A March 2015 by Roseanne Jefferson

Good Day Postal Employees….

Its hard to truly express how grateful I am for the so many of you that have sent prayers and heart felt encouragement, during the past couple of years….today I am able to say, Hope has been in remission for one year, and we humbly thank you all. I am taking a few weeks off at the beginning of March to take my 2 daughters on a mother-daughter get away. I will be leaving the computer at home….just sayin’ so the column is going to be late.

Well let’s see if a “changing of the guard” will make any difference in how this agency operates. From ALL of my sources, changes are coming. The question is, are the changes…..same ^%) different day….or real impactful changes. I personally don’t understand why this continues to be a problem for the post office. Can you say RESTRUCTURE!! Meaning that, we as an organization have had MANY re-structures, and/or re-organizations, throughout the years. So why not do that now, and make meaningful changes to assist our organization during this tumultuous period……and by the way, begin at the top. Start at HQ and roll right down to trim the excess at the Area levels. Do realistic reviews of city and rural routes, incorporating reasonable delivery time frames, I mean just as a starting point!! If this agency has to change in order to survive, then lets do it before its too late. It’s no different than this question….how many of you still have pagers….??? Yea, that’s what I thought!

Q 1. Hi Roseanne, I started with the Postal Service on 1/30/1987. I started as a clerk and transferred over to the carrier craft probably seven months after I started, 9 months after that I became a regular. I then transferred back to my home state in 2003. So I am now a PTF again. I will be 60 on November 10 of this year(2015). My question to you is if I’m 60 and have 28 years of service with the postal service can I get full retirement , no reductions or do I have to stay until I have 30 years of service? Thank-you very much. LK

A 1. Hi LK, Yes you will receive full retirement, (because you meet the criteria of age 60 w/20 or more years of service. BUT since you are a PTF your “annuity estimate” has to be ordered BECAUSE it’s done manually (any position that is not full time…the annuity estimate has to be done manually), so order it NOW and take a look at it, so you KNOW what kind of money you are looking at in retirement. But without a doubt, you are eligible to retire NOW. Roseanne

Q 2. Hi Roseanne! I first want to thank you for taking the time to write this column as I look forward to reading each and every month. I have had many questions regarding FERS retirement that were answered by reading the retirement Q&A. So once again, thank you so much!! I have worked for the USPS for 26 yrs. I also have 4 years of military service that I have purchased time for. I am currently 52 years old turning 53 this coming July. I plan on working another 4-5 years. (depending on TSP performance!) My question is this: I recently read in Federal Times magazine that FERS employees will have the option of self plus one for health care. My wife and I have no children so it would be wonderful if I did not have to have the cost burden associated with the family plan. From what I read in the Federal Times this would provide a significant cost savings. I am hoping that by the time I retire this option of self plus one is a true option. Have you heard if Postal Employees will be included? Thank you for your time and consideration. P

A 2. Hi P Well, I have been predicting this for YEARS!! AND it makes sense. Why pay for the whole famdamily, when its just you and spouse. I will be reviewing this so I can see what time frame they are looking at. I will check to see if postal employees are affected by this change and get back with you. Roseanne

R 2. Good morning Roseanne and TGIF! I just finished reading your February column and I have to borrow a word from your text “WOW” I did not have the luxury of reading all of the e-mails shared between you and this Jack ### (oops did I really just say that?) but all I can say is how rude of him or her.

None of us should feel that you are responsible nor obligated to do all of the homework and COMPLETELY educate us on OUR retirement benefits. Like you, I know that the FERS retirement process can be confusing at times. With that being said, ignorance to a very crucial aspect of life is not always a good excuse. I try to educate myself the best I can. I seek advice and understanding form work colleagues and informed, wonderful people like you!

Please understand that you are providing a very valuable tool that most of us USPS FERS employee’s find very valuable and comforting at times. I can just imagine the types of emails you receive and the style of language used in them. After working 26 years for the USPS you can imagine I have heard and seen it all. I have to admit the last 8 years have been wonderful. I have worked in the BMEU for the past 8 years and love the job. The first 18 years were spent trying to find my way so to speak. I was hired as an LSM operator then had a litany of bids like FSM, Manuel flat secondary, bundle sorter machine operator, etc.. and yes of course 204B. Well enough rambling by me, once again thank you so much for all of your concern, support and knowledge. Have a wonderful day and an even better weekend! P

Q 3. Hello Ms. Jefferson. Thank you for the invaluable info you provide for employees thinking of retiring. I left the USPS in January of 2013 and got much of the information in an understandable manner from your column. I just wanted to ask if you would agree with me on an issue that regularly appears in your column. Credit for unused sick leave. So many seem to be overly concerned with the 30-day increment thing. Realistically, how much, $ wise, does another 30 days add, to, say a 30 year, annuity? Would the employee not be $ ahead just to USE a day or two and forget about where the chips may land? Seems to me another 30 days towards retirement would add pennies. Am I missing something? Thank you.

A 3. HI, If you are FERS employee, then the increase is between $4.10- $ 4.40 per month….and that’s a fact. And so yes….use the sick leave….and always remember it MUST be approved, its not a “given”. But if looking at it from a fiscal perspective, and it being a month…use the sick leave. But also remember, that our total years of service and your sick leave are added together, so those two figures could bring you to a month. Roseanne

Q 4. Roseanne, I hope you can answer some tax questions I have regarding my retired 81 year old mother. She is a retired postmaster who worked in a very small town in Blank City, ANYSTATE. My mother moved out of that state. She has owed taxes every year and I was wondering if she should even have to file taxes at all. She lives on approximately $1900.00 a month and lives in a retirement home costing $1675.00. She has medical problems which require monthly medications. My question is: If she has no other income is she required to continue filing taxes? Thank you, LT

A 4. Hi Lynn, I wish I could be more helpful. But here is a shot, if you mother is a retired postmaster, then she no doubt is getting an annuity from OPM (Office of Personnel Management), the same organization that all federal retiree’s are paid from. As a retiree, I know I get a 1099 every year for the my “annuity” income, and I suspect that would be the same with her. Perhaps her age or the year she retired could have a bearing on her not getting a 1099, although I think that is stretching it. If i were you, and it was my mother, I would check with a a CPA or financial expert, which I am not, to find out the precise information. Your mother has a CSA number (all retirees do), and that number or her social security number could help you find out from OPM why she is not getting these 1099 for income. You can go on line to opm.gov or you can call OPM at 1-888-767-6738. Roseanne

Q 5. Hi Roseanne, I am very confused about retirement. I ordered my annuity estimate and blue retirement booklet. When I called HRSSC and asked about about retirement information, I was told that all of this “information” that I was looking for would be answered during the phone session. All I had to do was confirm a date and time for the phone session. I confirmed the session with HRSSC and called in. I was not the only person on the phone during this retirement counseling session. As far as I could tell, there were about 10 maybe 12 other employees on this same phone call. The session was not very helpful for a FERS employee. They could not tell me about Social Security, or TSP. If this is a part of our retirement plan, then why isn’t that a part of the retirement session that is done on the phone by HRSSC? I don’t know any more than I did before I called. Totally Frustrated!!

A 5. Hi TF, For me, this is not new information, I hear this all the time. I would suggest that you review some of the video’s that are on line at liteblue or postalease, as it relates to the FERS portion of your retirement. I hear what you are saying about your 3 tiered retirement. But you do have to understand, that HRSSC would never know anything about your Social Security (or even how much it would be); they have no idea about how much you have in your TSP account, so really, they couldn’t tell you anything about those 2 parts of your retirement plan. I am not saying that this is the ideal type of retirement session. But the true reality of it is, even when there was a personnel office in each district, we still were not able to give information to the employee about anything that had to do with Social Security or TSP. This is too important to NOT look into this further, so you are comfortable with retiring. Roseanne

Q 6. Dear Roseanne, I just took the local VERA offered here in Anytown, State (been retired for 2 weeks now [as of Feb 1st] and am loving it!!!) but can’t seem to find the answer as to where and when my lump sum annual leave check will arrive. I have spoken to various people (local union prez, HRSSC, etc.) and everyone has a different answer. I understood that it would be mailed to my “office of record” (which would be the GMF here)–is this true and, if so, will they ( Postmasters secretary, my old supervisor, ?) mail it to me or do I have to go pick it up?

Further, when should it arrive? Does it get mailed out as of my last official paycheck (Feb 13th) or does it get processed by OPM and go out at a later date? I was counting on it ($12K) to get my wife and I through till OPM gets my retirement processed. Any info is greatly appreciated. Thank you for your time and attention and let me say you were, are and will continue to be a blessing to all us USPS employees. Thank you! Sincerely, BC p.s. Hope your daughter is continuing to get better, and our thoughts are with her.

A 6. Hi BC, Hi Brian, It Always amazes me that this is not discussed, such a “mystery” that just should NOT Be!!! Who wants to be stressed out over this part, which is pretty typical scenario for almost ALL postal employee’s if not ALL postal employees.

After you get your SF Form 50 “Retirement”, that means that you are no longer ATTACHED to the Postal Service…therefore, if you are not “attached”..then neither is your bank account…and so what happens is that your last pay check, and perhaps your annual leave check (seldom does it come on the same check as it did years past)…will go to pay location 999 in your finance number. Every Finance number has a pay location “999”, and that where ALL checks go, that cannot be sent electronically to a bank, (because that employee no longer works in the (postal) system)). And again, it cannot be sent to the bank because you are no longer “attached” to the postal service. Depending where you work…i.e., if you worked at Itty Bitty Town,USA, the typically the Postmaster would mail it to you. If you worked at a large plant, then it would be in the Plant Manager’s Office and so on. Of course, you can always go and pick it up at your last office of employment, as this is what most do when they retire. And thank you for asking about my daughter. I am planning a getaway for my daughters…it’s been a long couple of years!! Roseanne

R 6. Roseanne, Just wanted to thank you so very much for the real deal info. My wife didn’t believe that there were still people out there who would provide such a wonderful service for nothing, that is, strictly out of the goodness of their hearts but she is now convinced. You are a blessing to all us USPS employees—Thank you..Sincerely, BC

Till we speak again….Roseanne

Postal Retirement Q&A April 2015 by Roseanne Jefferson

Good Day Postal Employees

Whew…….the only thing I can add to what you all already have been pummeling me with emails is know this….It’s NOT YOUR plant, or YOUR post office. Everything that happens where you are, happens in every other postal facility all over the country. I could write a book, or maybe I should write a book. As I have always encouraged you – KEEP up with your records. Get your financial papers in order, and above all, open your mail! Review your personnel file in lite blue under MYHR (you are looking for your eOPF). Get familiar with the forms in your file. Know the difference between a Form 50 (Notification of Personnel Action SF 50) and an SF 2809 (Health Benefits Election). Knowledge of your retirement system is the key to a successful retirement in the future.

Q 1. Hi Roseanne, I have a retirement question I was hoping you can answer for me. I am 46 years old with 20 years with USPS. I was wanting to retire at 55 years old and take getting penalized the 5% a year (2 years early), but was wondering if I still get the social security supplement at 56 1/2 still or do lose out on it because I would retire before minimum age requirement. I realize I can’t get it at 55 but can I pick it up at 56 1/2. Thank you for all your work you do for us, it is greatly appreciated. M

A 1. Hi M, Just from your question(s), I can tell you really don’t understand the process…and even the criteria to retire.

1. If you are FERS, its VERY unlikely that you can retire at age 55 (CSRS yes….FERS no)

2. I know you are FERS…so 55 is just not a discussion

3. If your MRA is 56 or 57…if you were born 1970 or later, your MRA is 57. If you were born in 1969, your MRA is 56 & 10 months; if you were born in 1968, your MRA is 56 & 8 months. So now we have cleared up your MRA issue…

4. NO you will NEVER get the Special Supplement if you don’t retire AT your MRA & 30 or more years; OR age 60 with 20 or more years…unless of course there is an early out. Bottom line to your question, YES YOU WILL LOSE THE SPECIAL SUPPLEMENT. Roseanne

Quite honestly, this is a perfect scenario, when your reach your MRA, you will have a full 30 years. That would entitle you to the special supplement, until you reach age 62, when it’s your first opportunity to collect Social Security.

Q 2. Hi Roseanne, I have a question about what counts as income against the fers supplement. I have 27 years plus 4 years (paid back) military. I’ll reach my MRA in three years. I also will have about one year sick leave accrued by then. My understanding is that only my actual postal time counts towards the fers supplement (30 into 40) 75%, is this correct? I don’t plan to work elsewhere after retirement but we have stock interest and dividends that can be substantial , (over the $15,120 limit) , does this count as earnings that can reduce my fers supplement ? I’ve been heavily investing in the tsp so the supplement will be the bridge to carry me thru to the time until I can start drawing on it.

Thank you for your help and ENJOY your retirement ! W

A 2. HI W, The FERS supplement is to be a replacement, if you will, for Social Security, the third component in your retirement plan. Just like working when collecting Social Security (if not over 67), their is a limitation on your “earnings”. And TRUE only postal time counts in the special supplement (bought back military doesn’t count in the Spec Supp). I don’t know how interest or dividends would count as “earnings”…but I am NOT a financial expert in that area, and would suggest you find an accountant / CPA to ask if being age 62 and receiving Social Security, would your dividends and/or interest IMPACT the Social Security check. That would be a way of finding out that information, because it very difficult to get information about the special supplement. Let me know how it turns out. And thank you, I do try to help all out there that are hungry for retirement information. Roseanne

Q 3. Ms. Jefferson. I am nearing retirement and I’m carrying over 440 hours of annual leave each year. Would it be more advantageous to use up my annual leave prior to retirement or cash it out at retirement time? TJ

A 3. Hi TJ, There are several ways to look at it. One way is to KNOW that when you get (annual leave) in a lump sum, it is “mad” taxed…like you actually made that figure every 2 weeks. And you can imagine just how over the top the taxes are…. they take out Medicare, Fed Tax, State Tax, and any other bi-weekly issue that is applicable. So when you say “use it up”, I agree you earned it and you shouldn’t lose it. But it still does require supervisory approval for taking annual and that sometimes (especially now) is not just a given.

You will also deal with the issue of time frames in retirement, just as it relates to transitioning from a bi-weekly pay, to a monthly pay. It will take time processing your retirement application fully, along with hundreds of others that OPM is completing your retirement paperwork. But you are paid “interim” checks until your retirement is completely processed, (so that you have income). I would suggest a minimum 80 hours, but 160 – 200 is probably a good cushion, without too much taxes coming out. When I retired, I was paid for all my earned annual leave. I had hundreds of hours that if not for the early out, I would not have retired with that much annual leave…(because of the HUGE taxes on it). I had about $14,000 in annual leave (gross), net was around $7900. But its a choice that only you can make, because only you know your financial situation. Good Luck, AND Happy retirement….it is bliss!! Roseanne

Q 4. My retirement date is Sept 1, 2015 with 30 years and 8 months of service. I will be 56 in August, so this retirement will be based on my MRA. I also have 1000 hours of sick leave so I believe that will give me about an additional 6 months of service time. I received a pay raise this past January for the first time in either 3 or 4 years. I had been topped out as an 18 for the past 10 years. The increase was $4000. I will have to work and additional 2 more years to get the benefit of the increase since my salary was stagnant for 3 years. I guess I am trying to decide will it be worth having to work an additional 2 years and 3 months to get the full benefit of the pay increase. Hopefully, I would also see an increase in pay over the last 2 years as well.

Also, of concern… I did the unthinkable and dipped into my TSP which I now totally regret, and my TSP balance is not where I would like for it to be. But, hind sight is 20/20. The extra time would give me a chance to add more money to my TSP. I would like to think I could work longer, but the stress of the job is very tough. I’m thinking I could work else where with less stress, but I will have to pay back $1 for every $4 I make, because of the FERS supplement, right? And also, can I take the supplement until age 62, then take 1/2 of my husband’s social security and hold off on taking my Social Security until age 67 to maximize my Social Security benefits? I’m struggling to find the best retirement date for myself. Thanks for your help!

A 4. Your high 3 is your high 3…and if you were to get a raise every year….you would be chasing your tail….to try to get the high 3 to be the same as your current wage!! Without knowing precisely what your salary was, and is now with the increase, its hard to say. I assume you are a FERS employee and understand that FERS (retirement portion) is only 25% of what your entire retirement is intended to be. SSecurity weighs about 35% and your TSP weighs about 45%, for a full 100% retirement. The longer you stay, not only does your high 3 in your case, use the extra 4G’s a year as a base, but it does give you the higher percentage that the USPS deposits for you, as well as increasing the total of your TSP when you do retire. And then it gives you the opportunity to increase into the TSP fund before retirement. Roseanne

Q 5. Hi Roseanne, A quick thank you for all you do for those of us who are clueless. You are appreciated more than you can imagine. This should be an easy one…is the USPS Personal Statement of Benefits that is sent to us each year ever wrong !? On the back it shows the date of your first eligibility for full or reduced optional benefits. It shows my date as 1/13/16..the day before my 56th birthday. I will have 20 years 5 months. That doesn’t seem like enough from all I have read. Your thoughts ?? And thank you in advance..MZJ

A 5. Hi MZJ, I know…… that statement makes us look like WE rake in the bucks, but it does point out very interesting things like how MUCH your benefits really cost the organization. To answer that question I would need to know the following….

Based on your email here is what I know…EOD: 08–12-1995 DOB: 01/14/1959 – According the FERS rules you are eligible for retirement under the MRA+10..(age MRA (in your case 56)) and you have 10 (or more) years of service. You can retire……but at a HUGE cost….first it’s not FULL retirement, so your retirement is reduced by 5% for each year under 62 (and that’s 30%) AND ON TOP OF THAT, you are NOT eligible for the special supplement. So NO it seems like it’s not enough because its not really full retirement. Full retirement is age 56 with 30 or more years OR age 60 with 20 or more years or age 62 with 5 or more years. YOU can hang on another 4 years…..you can!! Roseanne

Till we speak again…….. Roseanne

Postal Retirement Q&A May 2015 by Roseanne Jefferson

Good Day Postal Employees!!

NO sermon, NO talk….straight on to the letters of the month…..

Q 1. Dear Roseanne, I have a friend who left the postal service after 20+ years of employment. At the time of the resignation, they took money out the TSP fund, after their separation. This was done because they could not find anyone to talk to about their resignation, and so not even thinking that they may have rights to a pension from their postal employment.

It has now been 10 years since the resignation, and she will reach her MRA in 4 yrs. I’m writing to you because I think there must be some kind of pension for her when she turns 55 and beyond even if she left way before her MRA. I’d greatly appreciate if you would tell me what options are available for her at this point and how best to go about it. I have the utmost respect for you for what you do for everyone who need valuable advice and accurate information. Thank you so much. Best regards, PS: Please, let me know if you need any additional information.

A 1. Hi, it sounds to me like this was a FERS employee, (because you’re referencing MRA, and MRA is for FERS employees, not CSRS). If after a resignation, and that former employee does not withdraw their retirement contributions, then depending on the years of service (& age), there is eligibility for a pension at age 62. What you read, if using 55, is about the CSRS fund and not about FERS. They are 2 very different retirements. 55 ” translates to CSRS, & MRA translates to FERS. ROSEANNE

R 1. Omg! Thank you so much for your quick reply. Yes, she was FERS and I was CSRS so I’m sure I got those two mixed up. That’s great if she can apply for her pension when she reaches 62. Would there be any difference in benefits in applying for her retirement between at the age of 62 and 65? If so which will make most sense in your opinion in general. Also where would she get an application when the time comes as she can’t get on liteblue or call HR. Is there a phone number that she can call with questions? Thank you SO much. I know she will be sooo happy to hear this. Thank you.

RR 1. I would suggest she try (when it’s time ) to contact OPM (Office of Personnel Management) PO Box 45, Boyers PA 16017. Additionally the phone number is 888-767-6738. Roseanne

Q 2. Hi Roseanne. I am a CSRS letter carrier with a retirement date of 12/12/2017. My spouse is a retired CSRS postmaster. I have carried FEHB on our family since we were married nearly 28 years ago. Our son is no longer covered on the family plan, but my husband and I both are. My husband was recently told that when I retire, it would be cheaper for both of us to choose “self only” insurance. I was under the impression that I would need to continue to carry insurance for us both since he has not carried FEHB within 5 years of his retirement. Please clear this up for me. Thanks so much for what you do! CH

A. 2. HI CH, YES, both of you can be covered as single coverage each. Remember, each of you have eligibility on your OWN employment. It does not matter WHO pays the FEHB, both of you have continuous coverage. You each could change each year, you pay family one year and spouse pay family the next year. OH, I don’t recommend it, it’s too confusing…..but it does make the point. Another thing that is valuable to know…this 5 years of continuous coverage…..is really 5 years continuous coverage immediately prior to your retirement…Just an FYI. You will be able to only to do this during either open season, or a “Qualifying Life Status Event”, and OPM does not consider retirement a Qualifying Life Status Event. AND I suggest you do this NO LATER than the OPEN SEASON of 2016, for the 2017 year…that way when you do retire both of you will have your own single coverage, and that makes things go so much easier. Roseanne

Q 3. Hi Roseanne, I typically use 30-40 LWOP days per year to perform Union duties. The union pays me the amount I would have made working for USPS. Assuming my salary is $60K, but I only end up earning $50K from USPS with the other $10K from the union, will my high 3 be calculated using the $60K or $50K? I’m guessing the $50K.Any other things I need to consider regarding all the LWOP use?? Thanks, KM

A 3. Hi KM, Typically LWOP does not affect too much when it is LESS than 6 months in each calendar year. And you are probably right. The annuity statement may actually show your High 3 as the 60 figure, but when it goes to OPM, they will recalculate, taking into account “the funding” into the FERS retirement system. Other than being prepared for that, and it may NOT reduce…that is about the only thing that I think that would be of a concern. Roseanne

R 3. Thanks for the reply. Greatly appreciated.

Q 4. Good morning , I will be 60 on 9-9-15. I will be having surgery and be on sick leave for some time, then using annual leave til the end of September 2015. I plan on retiring on Sept 30th, I will have 24 yrs 9 mos. From reading up on retirement and watching videos, I assume I am good to go? I thought I read somewhere that you had to be in a pay status on the day you retired, is that true? I should have enough time, between sick and A/L to cover me until the end of Sept. I want to make sure what my status needs to be on the date of retirement.

Thank you for your time..

A 4. Hi, Sick leave, Admin leave and Annual leave ARE all pay statuses. LWOP is NOT being in a “pay status” You can, as they say, sick leave or annual leave OUT if you wanted to and of course it was approved. Using all until the end is not going to negatively effect you. You won’t typically have the big lump sum check when you retire if you are using until your retirement effective date. Either way you are good to go…other than LWOP, sick and annual, they are pay status. And that you have to be in a pay status to retire…well….if you look at employees who retire under “disability retirement”, typically they have spent much time on LWOP…so it’s all really how you frame a question. Roseanne

Q 5. I have a chance to apply for a newly created supervisor position in our small home town. Would that help or hurt my retirement opportunities? I am the excessed mail handler?

A 5. JUMP ON THAT!!!!! Are you kidding….this will help to increase your high 3 average salary…(although there are talks of high 5 average),HOWEVER.. understand this….you are going to work your ass off….really, and that is trade off, with the salary and the increases. If you think you are going to work 8 hours a day, don’t bother in taking the job, you will be miserable. Think about it!! There is no right or wrong answer here……it’s you. Roseanne

Q 6. Hi Roseanne: I just came aware of your site and I have 2 questions for you:

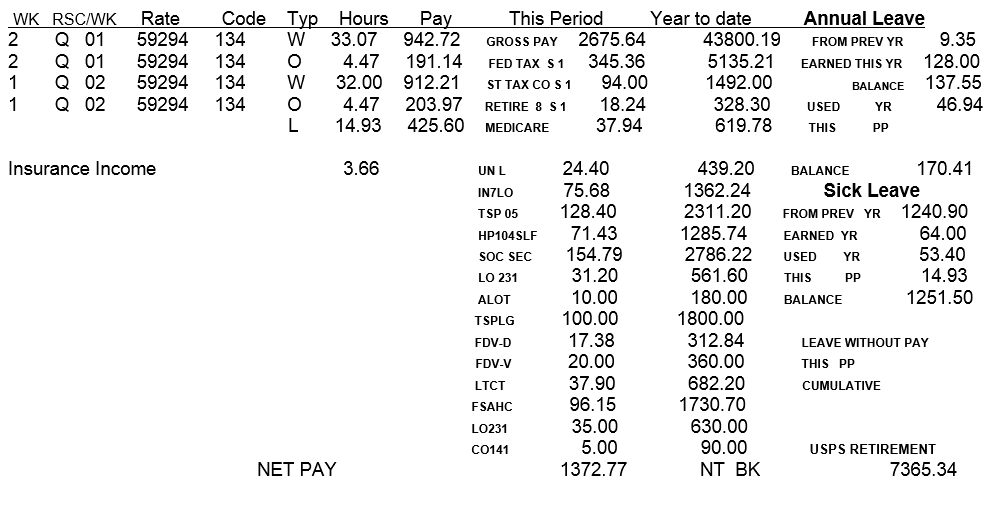

1) The amount on your check under USPS retirement on the bottom right , is that a lump sum payment?

2) I will retire in March 2016 with a few months of sick leave and I need minor surgery which will put me out 6 to 8 weeks. Would it be beneficial to me to take the 8 weeks of sick leave or have the surgery after I retire. Thank you in advance TR. PS I wish I found postalmag.com a long time ago!!

A 6. Hi TR, that amount is the amount of money at the bottom of your pay stub is what “ YOU” have contributed to the FERS retirement fund (bi-weekly)totaled for your entire career. If you notice it only changes once a year and that is PP2, when you begin anew with leave, and carries that year-tp-date balance to that bottom figure. AND NO…..it’s not paid in a lump sum to you. First, if you have ever looked at an annuity estimate, you would see very quickly that “that money” at the bottom of your check “that money”….would only last around 8-10 months….so to think that you would get that in a lump, then there would be NO BASE OF MONEY in which to establish for an annuity.

As far as ANY leave is concerned, it is always more “valuable” used versus being paid, or rolling over to credible service years, so that addresses question number 2. Good luck on your surgery and speedy recovery…..to the bliss of retirement. Roseanne

Q 7. Roseanne, hope all is well with you and your daughter. I’ve emailed you in the the past you were very helpful. I joined the ranks of the retired July 1, 2014 and couldn’t be happier. I was a carrier for 26 years. My question is concerning critically ill employees. An ex coworker was diagnosed with terminal cancer. He is eligible to retire without penalties under FERS. I thought I read somewhere that if you have a terminal disease you can withdraw our limp sim your retirement contributions. His wife passed away some years ago and has an adult child. I don’t know but I think if your life expectancy is less than 2 years you are eligible for this. I also believe if your life expectancy is no more than 9 months, then you can elect a living benefit and get your full value of your life insurance in the FEGLI program. I searched the internet and couldn’t find anything. I know you get a million emails, but if you could expedite this his daughter and I would greatly appreciate it. Thank you SO much. AG.

A 7. Hi AG, What a nice thing to do for someone. You are correct, if his physician will “narrate” on paper that this employee has less than 12 months, then that employee can apply for an “Alternative Annuity”. The amount that is at the bottom of the pay stub (+the ytd on the paycheck/stub) is what an employee has contributed to the FERS retirement fund. Under those conditions you outlined, the employee would be able to withdraw all of his contributions and STILL BE ELIGIBLE for a monthly annuity. This information is from OPM so, based on what I put in red, yes he should apply with HRSSC at 1-877-477-3273 to begin this process right away. And things health wise are still “stable”, and thank you for asking. I hope this will put your friend on the path to retire. Roseanne

Chapter 42

Section 42A4.1-1 Postponing Retirement Benefits (Cont.)

Health and Life Insurance

Coverage (Cont.)

Alternative Annuity Election

Reemployment in a Federal Agency Before Postponed Annuity Begins

Survivor Benefits

NOTE: FEHB and FEGLI coverage is reinstated prospectively even if the individual decides to receive annuity retroactive to the first of the month following separation.

An individual who chooses to postpone his or her MRA + 10 annuity may elect the alternative annuity when OPM adjudicates the postponed annuity benefit. Only an employee or separated employee who has a life- threatening affliction or other critical medical condition currently listed in CFR 842.707 may elect the alternative annuity.

An individual eligible for an MRA + 10 annuity who is reemployed in a Federal agency before he or she begins receiving regular annuity payments is treated as an employee and not a reemployed annuitant.

If an employee separates from service after having met the age and service requirements for an immediate MRA + 10 annuity, but dies before actually filing an application for retirement, he or she is deemed to have filed that application. The former employee is considered to have died as an annuitant, thereby ensuring the rights of survivors to the following benefits:

Annuity benefits to a surviving spouse.

Annuity benefits to children.

Eligibility of survivors for FEHB coverage if the deceased was eligible to continue coverage as an annuitant and had been enrolled for family coverage.

The lump sum payment to the person or persons entitled under the order of precedence. (See Chapter 34, Designation of Beneficiary, for the order of precedence.)

A separated employee who is eligible for an MRA + 10 annuity may not receive a refund of his or her contributions to the retirement fund even if he or she has not applied for an immediate annuity benefit

AND FINALLY

Q 8. Hi Roseanne, May I share your article on my Facebook page monthly? BTW I do appreciate your contributions to us, thank you TG

A 8. HI TG, Well I have really given this some thought. I was even on an airplane and talked to a doctor about it, (he also is a contributing editor to a medical magazine….much like I am a contributor to postalmag). If you will look on Postalmag you will see that under the column is also a Facebook “add-on” if you will…..I don’t answer that, nor do I look at it. Retirement is way too personal to have that which what I write about in the column-on what is a “social media” entity.

Consider this ……you read my columns…..you know I know many things……so I don’t NEED a Postalmag, or any established column, I could write a Facebook column called Jefferson’s Chimes of Knowledge, which is what my company is called, and it is a company of ONE!! JUST me!! But I don’t for the reason’s I have given you above. I have many many times have had people write me and tell ME about MY BLOG…..really, because I don’t have a blog…..so whoever is answering a blog…..it isn’t Roseanne Jefferson…..or maybe people refer to Postalmag.com as the blog???

I have NO problem with you directing those interested in knowing all this important information about retirement to Postalmag and really am flattered that you want to do this for your fellow employees and I’m all about getting information out to everyone…so if you would, please direct them to Postalmag.com…..and I will (if its OK with you, post this letter in next month’s column). Roseanne

Follow Up: Roseanne…

Thank you for responding… in actuality I do refer my colleagues to Postalmag. I do encourage them to read the archives and such. What I am discovering is the lack of information from local sources concerning FERS retirement. The local did finally provide an informal seminar, however, I believe it was CSRS biased and understandbly so. FERS is actually just coming into relevance. With all of this said I do not mind at all if you post our correspondence in your article. (I am great full that you are gracious enough to enlighten us). Until we meet again TG

WHEW!!!!!!

Till we speak again…………..Roseanne

Postal Retirement Q&A June 2015 by Roseanne Jefferson

Good Day Postal Employees!!!

Thank you to all the dedicated men and women that served in the Armed Forces keeping our country safe!!!

Q 1. Hello Roseanne, I am a disability retired rural carrier who was under CSRS. At the time I retired I was under the 55/30 retirement age and therefore took a substantial cut to my retirement benefit. My question is this: under the circumstances will I still be affected by the 2/3 offset when I file for my spousal benefit for Social Security? I asked at our local SS office but they were unable to give me an answer. Thanks in advance for any help you can offer. RT

A 1. Hi RT, You say you took a substantial cut to your retirement (I assume because (you think)) because it’s a disability retirement. But that is not true at all, not at all. The calculations of a disability retirement (CSRS) are as such that typically your are paid more than your actual years of service, OR your actual years of service, with no reduction for age.

That being said, I do believe that you will be affected because you still would be considered “double-dipping” at least for the purposes of this financial conversation when you collect the spousal benefit. IF the SS office can’t tell you “precisely”, it really won’t matter that much as you WILL find out because OPM will send you information about the “changes” to your annuity. Roseanne

R 1. Thank you for your timely response.

Q 2. Hi Roseanne, I discovered your Q&A forum with PostalMag Facebook page last night. Thank you for providing so much valuable information to us. I am looking for your input on my situation. Well over 10 years ago, I was forced to resign for medical reasons, with EEO implication. I was offered disability retirement, since the post office could not comply with a reasonable accommodation due to my medical restrictions as a mgmt employee (EAS-20), even though I had been on accommodations since the very late 90’s. I am a civil service employee and have been a disability annuitant since 2004. Last April 2014 I started a journey to request to be reemployed non-competitively as a disability annuitant into my former position as an EAS17 and identified vacant positions in the level that I was qualified to perform the duties with or without reasonable accommodations.

After six months of no response or action, the A/HR Manager at that time sent me a letter told me that she wasnt in the market to hire EAS employees as she could fill them internally. She referred to Chapter 100 of the CRCS/FERS Handbook. She told me to apply for a PSE job although I would be working for nothing as offsets would affect my annuity. I explained to her the rules that OPM has regarding reemployment and reinstatement of persons on disability annuities and the procedures outlined on the same. I pointed out that there are exceptions further down in the paragraphs Chapter 100A1.1-3 that could assist her but the more I tried to share with her, the more defiant she got. This back and forth banter went on for four months and during this time I sent emails requesting consideration for vacant EAS positions that were open to All Career Employees. At one time she sent me a letter asking what my disability was related to. I had contacted a Disability Law Center and they were incensed by her email. The advocate was a former OPM lawyer that I spoke told me that the PO never complies with the law.

So my question to you is : Do I legitimately and legally have the option to return to my former or similar EAS position if such vacancy exists and if so, How do I make the post office comply with my request especially when vacancies are present and open to all employees. I am not medically recovered as I have fibromyalgia and it is a chronic condition but can manage it through lifestyle changes. I am seeking an administrative recovery by returning to my former pay grade and level. I have been in contact with OPM and they do not see why I cannot be rehired under the rules and regs set forth by them as well as the Reinstatement Act of 2011 and all they would need is a hiring authority notification. I appreciate any feedback you can give me and I look forward to your response. If you would like to speak with me, I would love that. Thank you for your time.

A 2. Hi – I really understand this from ALL sides!! Management’s side, your side and OPM’s side. You are correct in that the rules provide an avenue for those who are on disability retirement to return to duty (reemployment)….and WHO COULD make that happen….well OPM could, in terms of regulations. But the PO still has the right to make a final decision on that. Because the rules/regulations’ “allow” this, it does not mean it’s a “requirement” that the PO has to follow. And they won’t. The Organization is trying to downsize and they are constantly looking for jobs for displaced “affected employees who are losing their jobs” who need a landing spot, And this job you are talking about is a landing spot for an employee who is losing their job. Bear in mind that if the employee happens to be a disabled veteran, well, that job is most definitely going to the Veteran. But IF you are NOT on SSDI (meaning you were not approved for Social Security disability) and probably wouldn’t be if a CSRS……but you can still have gainful employment.

You are able to work ANY job (provided it is NOT a FEDERAL employer) and it will NOT affect the OPM annuity. EVERY answer to every person is NOT the same. So my opinion….STOP trying to go back, its NOT the same place, and you can still work a job, and maintain CSRS disability also. Understand, your disability is based upon you not be able to THAT JOB YOU HAD AT THE POST OFFICE, it does not mean you cannot work anywhere, anytime anymore. I hope this has helped. Roseanne

Q 3. Good morning Roseanne. Thank you for all your knowledge. Wish you would write a book on retirement. Seems you are the only one out there with the actual correct answers. I have a few, but for the clerks I’ve asked I’ll share this one. We are FERS. Our sick leave is now 100% . Soooo how does that add up at retirement?

Example…29 Yrs service, (1 yr .SL). If you work 30 yrs., and add 1 yr.of SL. seems there is no $ advantage. We’ve been told the hours of SL accumulated add to time worked. Can you explain this more clearly for us. (Working 29 yrs , then SL of 1 yr can not be used for last year, am I correct… ?) I’ll have 25 yrs in Nov, and will be 53 in Dec.& am so ready to leave. My husband is done in Jan. from his job. It’s going to be so hard to stay. Thank you for your continued help.

A 3. Hi S I can explain it. Sick leave is “added” to your overall years of service and actually not just years but full months as well. So in your scenario of working 29 years, and then adding the 1 year of sick leave TO MAKE 30 YEARS….is where you are all getting hung up on. You cannot use sick leave to (add to your years of service to “GAIN” eligibility).

FERS Full eligibility is MRA +30 or Age 60 +20 or 62 +5.

SO if you are 60 with 19 years of service and 1 year sick, you can’t use that sick leave to GAIN eligibility. But if you are age 60 with 21 years and 3 months of service and 1 year of sick leave, then your annuity is calculated as 22 years and 3 months. Sick does count towards the “calculation” of your retirement, but NOT to gain the years of service. I hope this helps everyone understand better

FYI….I’ve been doing this awhile, most retirement calculations, for each month added to the retirement calculation (for the average FERS employee/retiree) typically adds about $4.00-$4.50 per month to the monthly annuity..(for life).

R 3. I never expected to hear from you so quickly, thank you so much. I will share this with my co workers. One of them is convinced he does not gain anything by not using up his SL before he leaves. I will show him your response. ($ 4-$4-50) again…. You are awesome. Have a blessed day ?

Q 4. I am retiring on 02-02-2016 and I am a FERS employee. I was on hired on 9/15/1984. I am confused, why should I not be a FERS (I always thought I was one of the first) but I will pass on to my fellow employee Nov 1st one day longer than she thought (she is a CSRS, thanks) NC

A 4. NC………STOP>>>>>>>

NOW -Lets start all over. First WHY in the world would you retire on the 2nd of the month if you are a FERS employee…that’s just a totally wrong move ..period, flat out – the wrong move. Tell me why you, as a FERS employee, would retire on the end of the month? After that we will deal with the other date and that is a CSRS. Roseanne

R 4. From day one, my records show that I am eligible to retire 02-02-16 (my 56th birthday)…I guess I’m not sure what to do…please advise. Is it better to wait until the end of the month?? Thank you for taking the time to help me! R

RR 4. Hi R, Yes you can retire at age 56…your MRA, but unless you have a full 30 years of employment when are age 56, that is NOT FULL retirement. That is an MRA+10 retirement and it will reduce your annuity by 5% for each year under 62 AND YOU WILL NOT BE ELIGIBLE FOR THE SPECIAL SUPPLEMENT. You’re worried about the end of a month, and you should be worried about how much money you’re going to lose if you retire at age 56 if you don’t have a full 30 years. READ up on MRA +10 type of retirement, I call it “sucker move”!! But to answer your original question, you should retire at the end of the month if you are a FERS employee. Only CSRS have the option to retire either on the 1st, 2nd or 3rd of the month, and still be eligible to receive an annuity for that month.

Q 5. Hello Roseanne, I am trying to get information about how to go about being able to increase my service time by buying back some of the time that I was a RCR. I was hired by USPS in 1986 and became an RCR shortly after that time, but didn’t become full time carrier until July 1996 when the carrier retired. I need information about buying back time from those 10 years that I carried but was not full time. How much of that time am I eligible to buy back and what is the fee? Do you know who I should contact to get the paperwork started so that I can do the buy back? Thanks for the information. S

A 5. Hi S. In order to buy back your non-career rural time, you must call HRSSC at 1-877-477-3273. They have all of your records of dates of employment and what “years” you are eligible to buy back. There is no fee, this is a part of your employment rights. Call them and get it started…but understand it may be more $$ than you are willing to pay OR it could be that the reduction is less severe than paying the amount back, as it will have interest calculated into the payback. Roseanne

Till we speak again…….Roseanne

Postal Retirement Q&A July 2015 by Roseanne Jefferson

Good Day Postal Employees!! Happy Fourth of July!

Some questions this month will be answered a bit differently, due to the length and/or format of issues contained in the question.

Q 1. Hi Roseanne! Thank you for your help. I am a FERS employee who will reach my MRA this October. I began working at the postal service in April 1986. Previously I worked two summers in a temporary civil service job with the Department of the Army in the late 1970s; I bought this time back and has been credited “in fund”, so my retirement computation date/annuity computation date is Nov. 1, 1985. If I retire on Nov. 30, 2015 will I be able to receive the FERS special supplement; I will have over 30 years of service plus my MRA but not all the time was with the postal service. Thank you so very much! M

A 1. HI M, Great question……this is what I KNOW….FERS employee’s who are eligible for the Special Supplement and were in the military and PAID their military back, those years are NOT paid in the Special Supplement. That I know for fact. OPM won’t address the why of it, just that it IS that way. So at best, those years you paid back you may not be paid for in the Special Supplement. I have not come across this issue…as it relates to bought back time from another federal agency. As long as you are at YOUR MRA and you have 30 or more years, you are eligible for the Spec Supplement. Roseanne

R 1. Thank you so much!!

Q 2. Hi Roseanne, I am hoping that you may give me some advice.

I am thinking of retiring Jan 1, 2016. I will have 35 years in Dec 2015.

I currently have over 600 hours AL and if I calculated correctly, I will use them starting Nov 21 through Jan 1 (which is the end of a pay period) and carry the remainder over.

I am wondering if this is the best way to do this. Is there a better time of year to retire – early or later in year? Any advise as I start this process will be helpful. I have watched all the videos, done a lot of reading. I just want this to go through smoothly. I have NOT yet started the retirement process. Thank you so much!

A 2. Hi K, you need to start with that 600 hrs of AL you say you are going to be paid of either by using it prior to retirement or getting that big annual leave check after you retire. You didn’t say, so I will include this: . Maximum carry over for craft is 440 & for Mgmt 560. Begin with that understanding, and know you will need to have their(USPS) approval to use those annual hours… that you will NOT BE PAID FOR over the maximum after retirement.

So you got a plan, now plan to make sure you don’t lose any of the annual leave you have EARNED!! And, it is always better to retire at the end of the year. (When I retired it was in August, and as Management I lost the FY increase in Sept).….I didn’t see much of a difference…other than I was not able to “manage” my annual leave (due to an early out situation)). When you are ready, call HRSSC for an appt about 4-6 months prior your effective retirement date. They will send you an annuity estimate and a blue retirement booklet to begin the process of retiring. Roseanne

Q 3. Dear Roseanne, I have recently completed (05-2015) buying back my military time with a one-time payment (that covered the initial deposit and the interest); and have received the OPM Form 1514 showing the payment and a zero balance. My question is what should I verify in my eOPF folder that would reflect the added six years of service that I purchased. Thanking you in advance for any help you can offer. Sincerely JT

See below the RTR Employee Detail Report shows as of today’s Calculation Results:

Retirement Computation Date (RCD): 2001/01/27

Annuity Computation Date (ACD): 2001/01/27

Leave Computation Date: 1995/01/27

RIF Computation Date: 1995/01/27

TSP Computation Date: 2001/01/27

A 3. Hi JT, Well that information you provided does not appear to have your military time “calculated” into your RCD or ACD (which adds to your overall years of service) and will increase the overall monthly annuity.

Your RCD and ACD (if exactly 6 years of military bought back) should back up your EOD (enter on duty date) 6 years. If I started May 1st 1983, and bought back 3 years of military, my RCD and ACD would be May 1st 1980, and that is what my years of retirement calculations would be based upon.

I am going to assume you began in the PO on 01/27/2001. You were given that “military” time as it relates to RIF rules, when you were hired (reg’s)…but you are NOT being credited for those military years in your retirement calculations. Go to postalease liteblue and look in your eOPF to see if the Form 50 (Notification of Personnel Action) has been processed giving you this credit….because it has not been. You should be looking in your eOPF for OPM form 1514 or 1515. Roseanne

- How did you know that I began on January 27th 2001?